Lucinda

|

|

I think that people fail to think about compensation broadly enough. This tweet is typical:

Compensation isn't salary. It isn't even salary + incentive comp + equity + benefits. Compensation is all of those things + growth. In a startup, you are usually at a cash disadvantage in recruiting but you have the power of equity and, just as important, the power of growth.

I often hear from founders and CEOs of earlier stage companies that they can't bring on a senior hire they need because they don't have the cash. In that case, you can be outrageously generous with equity. I'm consistently surprised by an unwillingness of an entrepreneur who is stuck in neutral to share significant equity with someone who has the potential to get them moving. The equity will vest, so there is very little downside in giving someone 10, 20, or even 50% of your company in that case. Beyond senior hires, the magic is growth. Trying to convince a young marketer to join my company Real Food Works, I said "I can't guarantee you job security, but I can offer you career security." It sealed the deal and it was true–he's a VP of Marketing now. Out of college I started as a secretary to a VP of Sales for a SF-based startup then called Dial Info, later Automated Call Processing, and ultimately MCI. In four years I went from being a secretary to running a market, to running East Coast operations, and then to becoming a product manager. The opportunity for that kind of trajectory has value–it's compensation. Finally, a personal commitment to help someone grow has value. Being a good coach as well as manager will attract people because it has value to them. It's compensation. The flip side of this approach to selling value as an employer is how to assess a job as a candidate. Look at the numbers, then add the opportunity for growth. And a related note on internships. Until just a few years ago I was a dogged supporter of unpaid work, because I weighed the value of growth so heavily. And then I was enlightened by the argument that unpaid work is discriminatory, because disadvantaged people can't do unpaid work. Duh! I worked from age 15 and certainly couldn't have worked without pay. So, pay people a living wage and give them decent benefits–then add all the growth they can handle.

0 Comments

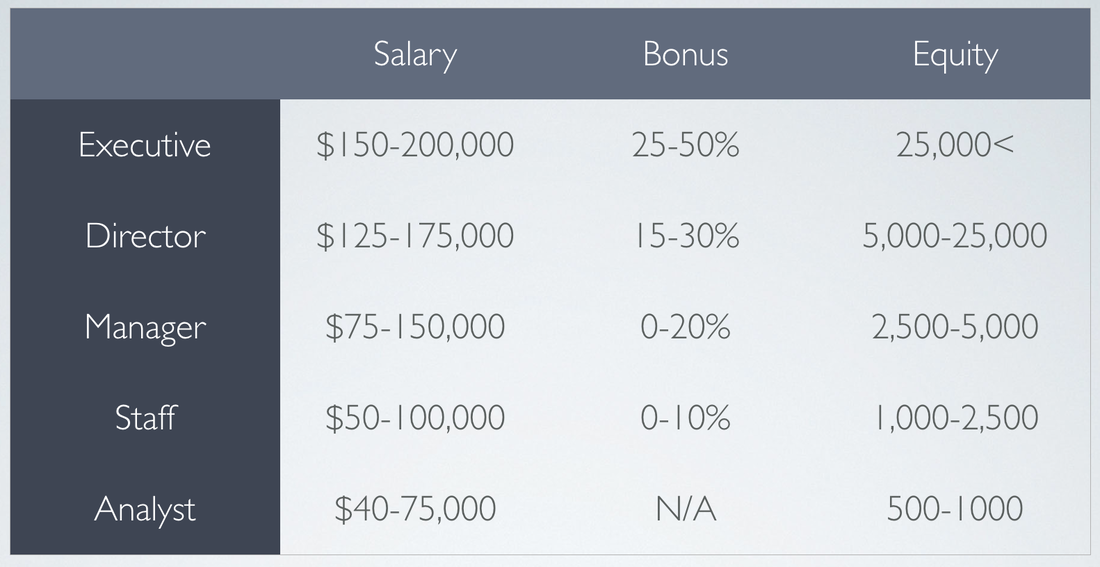

One of the best things about startups is zero bureaucracy. That said, there are a few lightweight structures that add massive value when implemented early. At the top of that list are setting a company cadence–which I'll write about in another post soon–and establishing compensation levels and bands. Banding is the practice of setting standard ranges for salaries, bonuses, and equity by level. As you grow, the matrix will become more complex, but at the beginning, you can start with a simple grid with 4 or 5 levels. Here's an example, with illustrative numbers. To build you own, get the best market numbers you can (investors often have this data, or Culpepper has a startup offering that's about $2,000.)

Taking the time to set bands lets you make faster compensation decisions: you simply select the relevant band, assess where the candidate should fall within the band, and make the offer. You can get Board approval to make offers within bands simplifying administration. Critically, banding will help you avoid creating compensation disparities that you'll have to rationalize later (which is painful.) I even use the bands to help employees understand where they fit and how they move up. An evening spent creating this simple compensation framework will pay back 10x. The venture capital-backed startup world is a bubble. People outside of it think we're risk lovers, which is reasonable since the our failure rate is so high. I think that the best entrepreneurs are risk managers.

Most people are enveloped by the emotion of risk, and it freezes them. They think about how terrible it will be if they fail, how awful every conversation with be explaining what happened. It's better to separate the emotion from the risk. Separate the fear of consequences from the consequences themselves. I do that by asking myself "What's the worst thing that can happen?" I explore that outcome, imagine the conversations I dread, think about what would come after the worst thing. Having fully considered the downside, I almost always conclude that the worst thing isn't really that bad. This same thinking works when I'm at the top of a steep ski slope, or at a cocktail party and have to make small talk, or when I need to have a hard conversation. All of those things feel riskier than they are. An emotionless view of risk allows entrepreneurs to make better decisions and take bolder action. |

Categories

All

Archives

May 2021

Me

I blog in spurts, about all sorts of things. |